ATTOM, a leading US curator of real estate data, today released its 2022 Grocery Store Wars analysis.

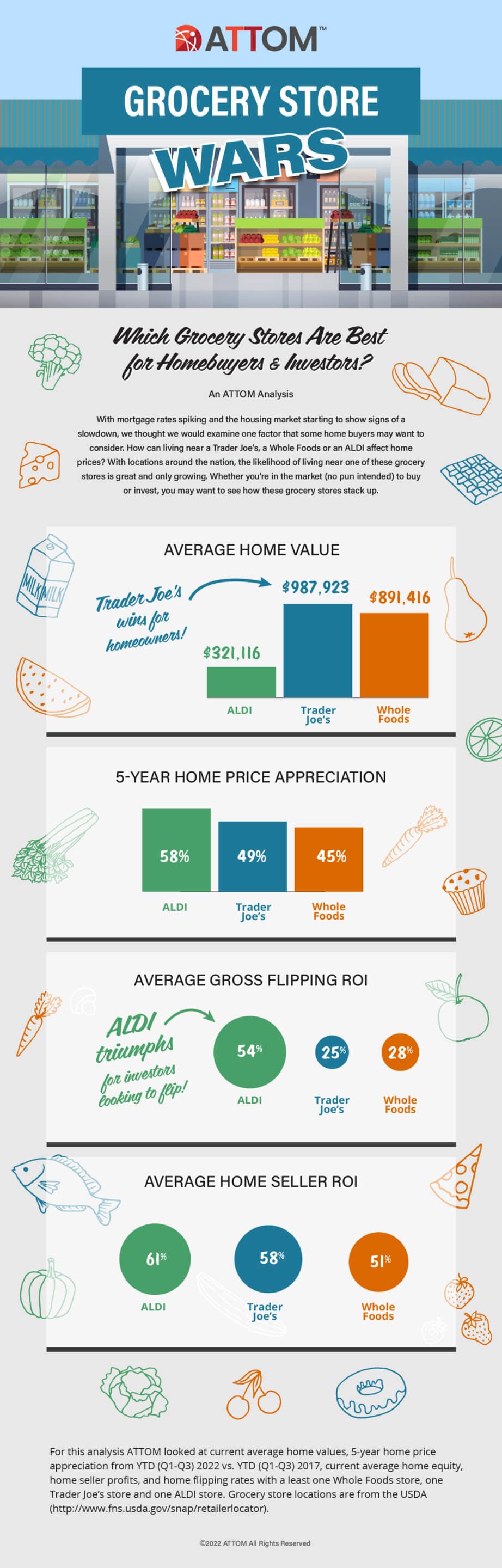

The analysis shows how living near a Trader Joe's, a Whole Foods or an ALDI might affect a home's value – as a homebuyer based on home price appreciation and home equity, or as an investor looking for the best home flipping returns and home seller ROI.

While homes near a Trader Joe's realized an average 5-year home price appreciation of 49 percent, and homes near a Whole Foods saw an average appreciation of 45 percent, ALDI had a slight advantage at 58 percent.

Analysis Reveals How Grocery Store Locations Impact The U.S. Housing Market: ATTOM

ATTOM, a leading curator of real estate data nationwide for land and property data, today released its 2022 Grocery Store Wars analysis, which shows how living near a Trader Joe's, a Whole Foods or an ALDI might affect a home's value – as a homebuyer based on home price appreciation and home equity, or as an investor looking for the best home flipping returns and home seller ROI.

For this analysis, ATTOM looked at current average home values, 5-year home price appreciation for YTD 2022 vs. YTD 2017, current average home equity, home seller profits, and home flipping rates in U.S. zip codes with a least one Whole Foods store, one Trader Joe's store and one ALDI store. (See full methodology enclosed below.)

“Smart homebuyers might want to consider where they'll do their grocery shopping when they're shopping for a new home.” said Rick Sharga, executive vice president of market intelligence at ATTOM. “It turns out that being located near grocery stores isn't only a matter of convenience for homeowners but can have a significant impact on equity and home values as well. And that impact can vary pretty widely depending on which grocery store is in the neighborhood.”

For Homeowners

While homes near a Trader Joe's realized an average 5-year home price appreciation of 49 percent, and homes near a Whole Foods saw an average appreciation of 45 percent, ALDI had a slight advantage at 58 percent.

However, not only does Trader Joe's lead the pack for homeowners with an average home value at $987,923, but it also takes the lead in home equity with homeowners earning an average of 50 percent ($520,842) equity, compared to Whole Foods at 45 percent ($433,311) and ALDI at 38 percent ($132,643). The average value for homes near a Whole Foods is $891,416, and $321,116 for homes near an ALDI.

For Investors

Properties near an ALDI are ripe for investors, with an average gross flipping ROI of 54 percent, compared to properties near a Whole Foods which had an average gross flipping ROI of 28 percent and Trader Joe's at 25 percent.

Properties near an ALDI have an average home seller ROI of 61 percent, while properties near a Trader Joe's sit at 58 percent, and 51 percent for properties near a Whole Foods.

Report methodology

For this analysis ATTOM looked at current average home values, 5-year home price appreciation for YTD (Q1-Q3) 2022 vs. YTD (Q1-Q3) 2017, current average home equity, home seller profits, and home flipping rates in U.S. zip codes with a least one Whole Foods store, one Trader Joe's store and one ALDI store. Grocery store locations are from the USDA (http://www.fns.usda.gov/snap/retailerlocator).

For corrections or follow-up: editor@spaceinfohub

You may like these posts too:

- Affluent American Buyers Looking Abroad for their Dream Home

- New sights stimulating Dubai’s economy

- Dar Al Arkan to Develop a Signature Trump Resort in Oman’s AIDA Project

- Better Launches One Day Mortgage(™) to Revolutionize Home Buying Experience for Americans

- Architects Propose a Sustainable Floating City for 50,000 People