The “Space Launch Services Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2028” report has been added to ResearchAndMarkets.com's offering.

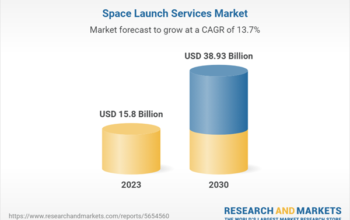

The global space launch services market size reached US$ 12.9 Billion in 2022. Looking forward, the publisher expects the market to reach US$ 28.1 Billion by 2028, exhibiting a CAGR of 13.86% during 2022-2028.

Clicking on the “Read Full Article” link below will auto-scroll you to the full article (same page).

Global Space Launch Services Market Report 2023: Sector to Reach $28.1 Billion by 2028 at a CAGR of 13.86%

The “Space Launch Services Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2028” report has been added to ResearchAndMarkets.com's offering.

The global space launch services market size reached US$ 12.9 Billion in 2022. Looking forward, the publisher expects the market to reach US$ 28.1 Billion by 2028, exhibiting a CAGR of 13.86% during 2022-2028

Companies Mentioned

- Airbus SE

- Antrix Corporation Limited

- Arianespace SA

- China Great Wall Industry Corporation (China Aerospace Science and Technology Corporation)

- Mitsubishi Heavy Industries Ltd.

- Northrop Grumman Corporation

- S7 Airlines

- Safran S.A.

- Space Exploration Technologies Corp.

- The Boeing Company

Space launch, or lift-off, refers to the earliest part of the operations, wherein the rocket or other vehicles, including airborne aircraft and floating ship, are vertically released from the ground. This process involves a series of activities, such as ordering, conversing, stacking, assembling, and integrating payload for launching spacecraft, which in turn, assist in decreasing the set-in motion cost and promoting a smooth launch.

On account of these properties, space launch services are extensively deployed by the government, space organizations, and military agencies for performing galaxy explorations. At present, these services are categorized into pre-launch and post-launch.

The widespread adoption of space launch services across commercial, government and military and defense sectors on account of the increasing number of aircraft and satellite testing during launches is one of the prime factors currently driving the market growth.

In line with this, significant technological advancements, such as the introduction of miniaturization in electronic systems for improving small satellites capabilities by reducing the size of various integrated electronics and hardware is acting as another growth-inducing factor.

This is further supported by the implementation of the commercial-off-the-shelf (COTS) approach, which is employed by space companies in the miniaturization methodology for collecting distributed data and experimentation purposes.

Moreover, the shifting inclination of space launch service providers toward smaller satellites over traditional satellites for enabling their development in a shorter time frame at lower launch costs is propelling the market growth

Additionally, the rising demand for low earth orbit (LEO)-based services, such as imagery-based intelligence and space-based communication, is also contributing to the market growth. Apart from this, the extensive investments in research and development (R&D) activities for designing, maintaining, and operating commercial payload facilities is creating a positive outlook for the market.

Key Market Segmentation:

The publisher provides an analysis of the key trends in each sub-segment of the global space launch services market report, along with forecasts at the global, regional and country level from 2023-2028. Our report has categorized the market based on payload, launch platform, service type, orbit, launch vehicle and end user.

Breakup by Payload:

- Satellite

- Small Satellite (Less Than 1000 Kg)

- Large Satellite (Above 1000 Kg)

- Human Spacecraft

- Cargo

- Testing Probes

- Stratollite

Breakup by Launch Platform:

- Land

- Air

- Sea

Breakup by Service Type:

- Pre-Launch

- Post-Launch

Breakup by Orbit:

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geosynchronous Orbit

- Polar Orbit

Breakup by Launch Vehicle:

- Small Launch Vehicle

- Heavy Launch Vehicle

Breakup by End User:

- Government and Military

- Commercial

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Questions Answered in This Report

1. What was the size of the global space launch services market in 2022?

2. What is the expected growth rate of the global space launch services market during 2023-2028?

3. What has been the impact of COVID-19 on the global space launch services market?

4. What are the key factors driving the global space launch services market?

5. What is the breakup of the global space launch services market based on the payload?

6. What is the breakup of the global space launch services market based on the launch platform?

7. What is the breakup of the global space launch services market based on the service type?

8. What is the breakup of the global space launch services market based on the orbit?

9. What is the breakup of the global space launch services market based on the launch vehicle?

10. What is the breakup of the global space launch services market based on the end user?

11. What are the key regions in the global space launch services market?

12. Who are the key players/companies in the global space launch services market?

For corrections or follow-up: editor@bizzinfohub

You may like these posts too:

- No related posts.